Integration of a Risk Analysis Agent for Companies and Startups in a Banking Environment: Architecture, Methodology and Results

Startup risk assessment is an intensive process that varies significantly between analysts. A European Fintech commissioned us to design and integrate an analysis agent capable of processing heterogeneous documentation, extracting key metrics, and generating a structured valuation comparable to an analyst's work. This paper describes the agent's architecture, the collaboration process with risk experts, the validation methodology, and the results observed during its integration into the banking product. Additionally, additional use cases are presented where document-based analysis agents can add value in banking, fintech, and other sectors.

Project Summary

We developed and integrated an LLM-based risk analysis agent within the platform of a European Fintech specialized in startup financing.

The agent processes heterogeneous documentation (pitch decks, financial statements, cap table, contracts) and normalizes it into structured metrics aligned with risk analysts' criteria.

The solution combines deterministic financial logic, qualitative analysis with LLM, and complete traceability to source documents, enabling consistent, auditable decisions compatible with regulated banking environments.

1. Introduction

Risk analysis in startups presents particular challenges: immature business models, volatile metrics, non-standardized documentation, and decisions dependent on expert judgment. In the banking context, this process consumes weeks per case and requires aligning criteria among different analysts.

To address this problem, we collaborated with an entity specialized in financing technology companies to develop a risk analysis LLM agent, integrated directly into their banking platform. The agent automates document reading, performs structured financial analysis, and projects the future evolution of the startup, always under human supervision.

This paper documents the solution from a technical perspective: architecture, pipeline, interaction with analysts, validation, and operability.

1.1. Technical Objectives

The primary objective of the system is to build a risk-analysis agent capable of supporting financial analysts in the evaluation of early-stage and growth-stage companies. The agent must:

Extract structured information from heterogeneous documents with high reliability.

Maintain end-to-end traceability between extracted fields and source documents.

Produce consistent, auditable valuations aligned with human analyst criteria.

Operate under strict latency and compliance constraints defined by the banking environment.

Support deterministic components for critical calculations while leveraging LLM-based reasoning for qualitative interpretation.

2. Methodology

2.1. System Requirements

The system must operate under the following constraints:

Extraction accuracy: reliably identify key financial fields despite document variability.

Deterministic consistency: financial ratios and risk metrics must be computed through deterministic modules.

Explainability: each section of the report must include citations linking to the original documents.

Operational latency: processing time per case must be compatible with analyst workflows.

Robustness: the agent must detect missing data, conflicting values, and low-confidence extractions.

Regulatory compliance: all data handling must remain compliant with European financial and privacy regulations.

2.2. Data Acquisition and Preparation

The project included the ingestion and normalization of multiple document types:

Pitch decks and business presentations

Financial statements (P&L, balance sheet, cashflow)

Cap table and shareholder agreements

12–36 month projections

Market and competition reports

Key contracts or customer agreements

Product metrics (when available)

Figure 1 – Document ingestion and classification:

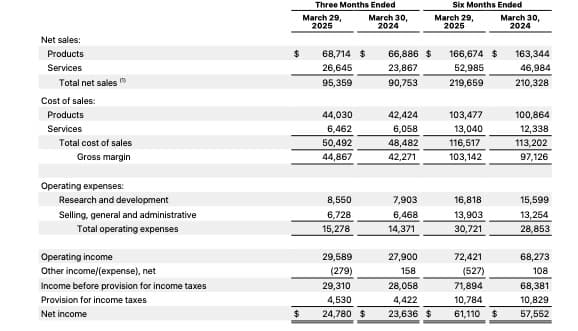

The following example shows how the agent processes a specific section of a real financial statement. From a fragment of the quarterly results document, the agent automatically identifies and normalizes the key metrics needed for risk analysis.

Original document fragment (profit and loss):

Figure 2 — Extracted fields panel from a consolidated financial statement

+-------------------------------------------------------------+

| Extracted fields panel |

+-------------------------------------------------------------+

| period_end → "March 29, 2025" |

| revenue_products → 68,714 M USD |

| revenue_services → 26,645 M USD |

| revenue_total → 95,359 M USD |

| gross_margin → 44,867 M USD |

| rd_expense → 8,550 M USD |

| sga_expense → 6,728 M USD |

| operating_income → 29,589 M USD |

| net_income → 24,780 M USD |

+-------------------------------------------------------------+This example shows how the agent not only reads the document, but understands its financial structure, extracts relevant metrics, and converts them into a usable representation in a risk analysis pipeline.

2.3. Collaboration with Human Analysts

Before training and adjusting the agent:

We conducted work sessions with senior analysts to define key signals.

We collected internal documentation: risk policies, scoring templates, and real cases.

We established explicit criteria for valuation:

- -Financial strength

- -Team composition

- -Realism of projections

- -Operational and market risks

- -Early signs of financial stress

The goal was to replicate an analyst's reasoning, with the aim of streamlining a process that takes weeks to immediate resolution.

2.4. Agent Architecture

The agent operates as a modular pipeline composed of:

Document parsing and normalization module

Financial metrics extraction engine

LLM module for qualitative analysis

Future projection component (three scenarios)

Risk report generator

Integration layer within the banking product

Figure 2 – Agent architecture:

2.5. Usage Flow within the Banking Product

The agent's actual operational flow:

The manager or startup uploads the documentation.

The agent ingests and classifies the documents.

Extracts key information automatically.

Performs a structured financial analysis.

Evaluates qualitative risks.

Generates a formal report in the bank's standard format.

The analyst reviews, corrects, and validates the result.

Figure 3 – Usage sequence:

3. Evaluation and Validation

3.1. Internal Benchmarks

Comparison between agent analysis and human evaluations in:

Document coverage

Identification of classic risks

Consistency between similar cases

Depth of qualitative analysis

3.2. Human Supervision

Each generated report was reviewed by expert analysts during the first weeks:

The level of necessary correction was measured.

Prompts and policies were adjusted.

New risk signals derived from real cases were added.

3.3. Agent Observability

The system records:

What documents were processed

What conclusions the model generated

Sections where the model shows uncertainty

This facilitates audit and transparency.

3.4. Quantitative Evaluation Framework

To evaluate the agent's performance in a banking environment, we define a quantitative evaluation framework consisting of:

Field-level extraction accuracy: precision and recall over ground-truth financial fields.

Document coverage score: percentage of relevant sections successfully processed.

Risk-assessment consistency: comparison between agent-generated valuations and historical analyst decisions.

Time-to-analysis: end-to-end processing time reduction relative to manual workflows.

Uncertainty measurement: confidence scoring for each extracted value and qualitative statement.

This framework allows continuous monitoring and ensures the system maintains reliability as document formats evolve.

4. Results

Initial results included:

Significant reduction in document reading time (40–60%).

Greater consistency among analysts from different teams.

Lower cognitive load on extensive cases.

Greater clarity for risk committees thanks to structured reports.

More stable projections, based on data signals combined with historical comparables.

5. Extended Applications

Agents based on structured document analysis can be extended to multiple domains.

5.1. Banking and Fintech

Risk analysis for SMEs.

Scoring for freelancers and micro-enterprises.

Automation of credit due diligence.

Advanced KYC/AML based on unstructured documentation.

5.2. Venture Capital

Dealflow evaluation.

Automatic comparison with historical startups.

Early signals of growth or risk.

Automated IC memo preparation.

5.3. Compliance and Audit

Regulatory compliance validation.

Internal audits based on documentation.

Detection of inconsistencies between legal and operational documents.

5.4. Legal

Massive contract analysis.

Identification of critical clauses.

Operational risk assessment in commercial agreements.

5.5. Insurance

Business risk assessment.

Documentary analysis of claims.

Automatic valuation of policies and coverage.

5.6. Public Sector

Subsidy evaluation.

Document processing for tenders.

Compliance audits in funded projects.

6. Design Considerations and Controls

As with any AI-assisted workflow operating in regulated environments, several aspects require continuous monitoring and engineering controls:

Document variability: low-resolution scans or handwritten notes are automatically flagged for human review to maintain accuracy.

Model evolution: the system includes versioning and evaluation pipelines to detect performance drift as document formats or business rules evolve.

Interpretation of non-standard disclosures: ambiguous financial footnotes trigger uncertainty scoring and analyst verification.

Structured guardrails for qualitative reasoning: LLM-based interpretations operate under deterministic constraints and field-level provenance.

Regulatory compliance: consistent with European financial regulations, the final decision remains human-validated, ensuring full auditability.

6.1. Operational Deployment Considerations

The deployment of the agent within the banking environment:

Integration through secure APIs within the client's existing infrastructure.

Role-based access control and encryption for sensitive financial data.

Automatic logging and auditability for every processed document.

Monitoring dashboards to track performance, latency, and extraction confidence.

Continuous support to adapt the agent as business rules or document formats evolve.

These deployment practices ensure the system operates reliably within enterprise workflows while maintaining compliance and operational integrity.

Let’s build together

We combine experience and innovation to take your project to the next level.